An easy way to Invest With Only $5 and Take Advantage of The Falling Stock Market.

We offer three subscription plans. Each plan is designed for a range of needs and goals and offers unique ways to save and invest. You can pick the plan that’s right for you, with the option to switch as your life changes.

Unlike other apps, Stash lets you buy fractional shares of stocks, bonds, and ETFs—with no add-on trading commissions*. We offer personal, retirement, and custodial (for children under 18) investing accounts.

Transparent Pricing

Stash Learn can help you become a finance whiz. Read investing learning guides, stay up to date on financial news, and get tips on saving, budgeting, and investing.

-

Automatic Saving & Investing

-

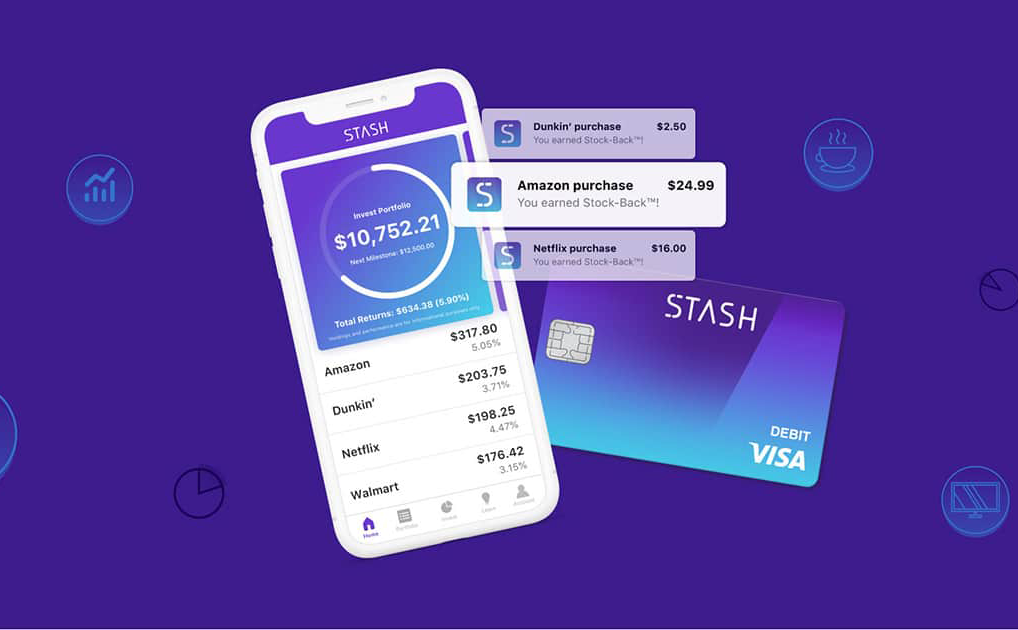

Earn Stocks & Funds As You Spend

-

Investing with any Dollar Amount

-

Budgeting money made simple

Make a budget and stick to it with partitions.

A new way to organize your money.

Get Your Pay Up to 2 Days Early

All plans include access to the Stash debit card, which comes with our FDIC-insured banking account. You can get paid up to 2 days early with direct deposit. Plus, no overdraft‖, minimum balance, set-up, or hidden fees.

Extra benefits:

Debit Account Services provided by Green Dot Bank Member FDIC, pursuant to a license from Visa U.S.A. Inc. Investment products & services are offered by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value. Securities offered through Apex Clearing Corporation, Member FINRA/SIPC.